Laurus Labs: Is it a Long term Investment Opportunity or a Value Trap or a Potential Default Candidate?

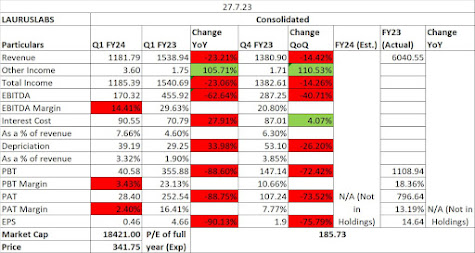

In the recent Q1 FY24 Results season, there were many companies that gave a bad result. One of them was Laurus Labs. Below is a snapshot of the result.

When the result was announced, the price soared but then it again corrected. It made a high of Rs. 418 and corrected until Rs. 380. The price currently is trading near that price that is Rs. 398.

So, I just thought of giving a look at the fundamentals of

the companies starting with the Balance sheet. I saw that Long term borrowings have

increased from 400 crores in March, 2021 to 761 crores in March, 2023. Short

term borrowings have increased from 886 crores in March, 2021 to 996 crores in

March, 2023. Sundry Debtors have also been increasing from 1300 crores in

March, 2021 to 1580 crores in March, 2023. Inventories have also been

increasing from 1575 crores in March, 2021 to 1685 crores in March, 2023.

Looking at the P&L, revenue has been very consistently

increasing during the last 10 years but margins are not being maintained which

is showing a lot of variability in the profitability of the company. Interest

cost has also increased by 75% in the last 10 years.

Looking at the shareholding pattern, promoter reduced stake

by 0.7% in December, 2022. The promoter shareholding is already very low at

27.2%. In the same quarter, they pledged a very minimal amount of shares that

are only 0.04% of the total shareholding. One positive factor was seen is that

there was an increase in stake of FII/DII shareholding.

Cash flow from Operating Activities has been positive an on

an increasing trend. Cash flow from Investing has always been negative in the

last 10 years. Final Cash shown on the balance sheet is very low. Even Cash

flow to sales ratio is low which suggests that cash sales are comparatively

low. Free Cash flow to company is also negative since last 10 years.

Coming to the detailed analysis of the fundamentals, I saw

that demand has been softening for generic products due to which there is

excess inventory. Also, USFDA issued a procedural lapse in the Vishakhapatnam

Facility. There was also fire in the same facility in December, 2022. Further,

the company has guided in January, 2023 that prices of APIs will not go down

further.

Revenues increased during Covid period because of increasing

demand of ARV APIs where in price realizations have also increased. The demand

and prices both have a taken a hit post Covid which has led to a reduction in

revenues. Contracts Sales were higher during Covid which reduced post-Covid.

Contract sales has been a 36% of their total revenue in 2022-23.

Their Capex plans for FY24 are around 1700 crores. This plan

is for Greenfield & brownfield expansion of various projects. Out of this,

300 crores will be financed via a term loan and 1400 crores from internal

accruals. (Here is a question in mind. Their Cash & Bank on Balance Sheet

as of March, 2023 is only 48 crores. So how do they plan to finance 1400 crores

from internal accruals? It could be by using up their 3900 crore reserves).

Also, they are now trying to transform from an RM supplier

to a Drug maker. They are targeting high growth opportunities. They made their

entry into Agrochemical/Animal Health by winning the first contract in Q1 FY24.

They are planning to reduce net debt by FY25 after all Capex has been done.

The question of the blog post still remains a question. Lets see how the price performs based on the fundamentals of the company.

Happy Investing!!!!!

Comments

Post a Comment