Laurus Labs Part 2: Is it a Long term Investment Opportunity or a Value Trap or a Potential Default Candidate?

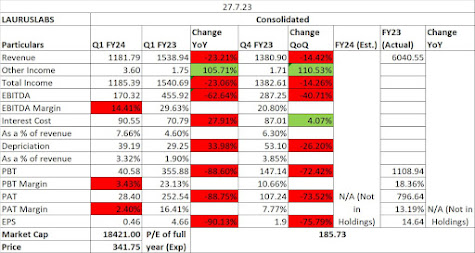

In my last post, I had pointed out some negative/positive points about the company. Currently, the company seems to be in a Capex mode as mentioned in my last post. The Q2FY24 results of the company was declared a few days ago. Below is the snapshot of the same. (Estimates of FY24 are assuming that the growth numbers in H1 FY24 will continue in H2FY24 and margins will remain on similar levels). The QOQ situation has been better but the same cannot be said for YOY. There are for more issues seen from the balance sheet of the company. Days of receivables increased from 61 days in 2014 to 88 days in 2023. Working Capital days also increased from 40 in 2014 to 86 in 2023. Reserves in 2014 were 277 crores which increased to 3918 crores in 2023. LT borrowings have also increased from 188 crores to 761 crores in the same period. ST borrowings have also increased from 312 crores to 996 crores in the same period. Based on this an additional question arises that why are they increasing debt...